Establishing Your Business: A Comprehensive Guide to UK Company Formation for Foreign Entrepreneurs

Hey there, aspiring global entrepreneur! Are you thinking about expanding your horizons and setting up shop in one of the world’s most dynamic economies? If so, then Establishing Your Business: A Comprehensive Guide to UK Company Formation for Foreign Entrepreneurs is exactly what you need. The UK offers a fantastic landscape for new ventures, boasting a robust economy, a reputable business environment, and relatively straightforward processes for company formation.

Why Choose the UK for Your Business?

The UK has long been a magnet for international business, and for good reason! When considering UK company formation for foreign entrepreneurs, you’ll find a wealth of advantages:

- Global Access: Its strategic location and strong trade links provide excellent access to European and global markets.

- Stable Economy: A well-established and stable economic and political environment offers security for your investments.

- Business-Friendly Policies: The UK government actively supports businesses with competitive corporation tax rates and a straightforward regulatory framework.

- Prestige and Credibility: A ‘Made in UK’ or ‘Registered in UK’ tag can significantly boost your brand’s international reputation.

- Innovation Hub: Cities like London are world-renowned innovation hubs, offering access to talent, technology, and funding.

Types of Companies You Can Form

When establishing your business in the UK, foreign entrepreneurs primarily opt for a few company structures. The most common and recommended is:

Private Limited Company (Ltd)

This is the most popular choice for small to medium-sized businesses. It offers:

- Limited Liability: Your personal assets are protected from business debts.

- Separate Legal Identity: The company is a distinct entity from its owners.

- Flexibility: Relatively easy to set up and manage.

Other options include Limited Liability Partnerships (LLP) or Public Limited Companies (PLC), but these are typically for more specific or larger-scale operations and less common for initial foreign ventures.

Key Requirements for Foreign Entrepreneurs

Worried about red tape? Don’t be! UK company formation for foreign entrepreneurs is quite accessible. Here are the core requirements:

1. Registered Office Address: You must have a physical address in the UK where official communications can be sent. This doesn’t have to be where you actually conduct business; virtual office providers are a popular solution.

2. Directors: At least one director is required. They can be of any nationality and do not need to be a UK resident.

3. Shareholders: At least one shareholder is needed, and they too can be non-UK residents. The director and shareholder can be the same person.

4. Company Name: Your chosen company name must be unique and not already registered or too similar to an existing one.

5. Memorandum and Articles of Association: These are legal documents outlining how the company will be run.

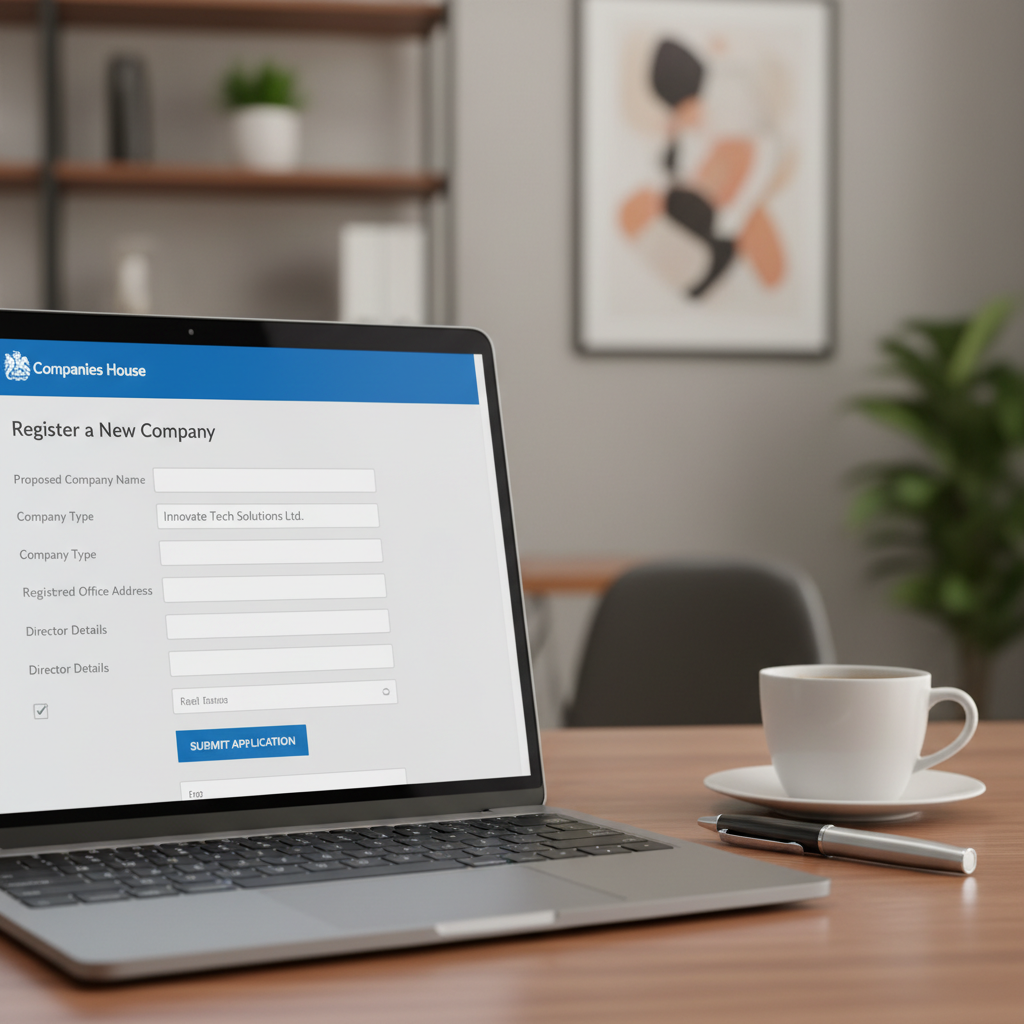

The Step-by-Step Process of UK Company Formation

Ready to get started? Here’s a simplified breakdown of how to go about establishing your business in the UK:

1. Choose Your Company Name: Do a thorough search on the Companies House website to ensure availability.

2. Appoint Directors and Shareholders: Decide who will hold these roles and gather their necessary details.

3. Secure a Registered Office Address: Arrange for a UK-based address.

4. Prepare Formation Documents: This includes the Memorandum and Articles of Association. You can use standard templates or consult with a company formation agent.

5. Register with Companies House: Submit your application online or by post. This is the official registration body for all UK companies.

6. Open a UK Business Bank Account: This is crucial. Many banks have specific requirements for non-resident directors, so research your options carefully.

7. Register for Corporation Tax: Once your company is registered, HMRC (HM Revenue & Customs) will usually be informed automatically, but it’s good practice to ensure you’re registered for corporation tax.

Post-Formation Obligations

Once your UK company is formed, remember there are ongoing responsibilities:

- Annual Accounts: You’ll need to submit yearly financial statements to Companies House and HMRC.

- Confirmation Statement: An annual declaration confirming your company’s information (directors, shareholders, etc.) is up to date.

- Corporation Tax Returns: File your tax returns and pay any due corporation tax.

Navigating UK Visas (Briefly)

While you don’t need to be a UK resident to incorporate a company, if you plan to move to the UK to run your business, you’ll need the appropriate visa. The UK offers specific routes like the Innovator Founder Visa or the Scale-up Visa. It’s always best to seek professional immigration advice tailored to your specific situation.

Establishing your business in the UK as a foreign entrepreneur is an exciting journey with immense potential. By understanding the straightforward process of UK company formation, you’re already on the right path. With careful planning and perhaps a little professional guidance, your UK venture can be a great success. Good luck!